net investment income tax 2021 calculator

These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are determined. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to.

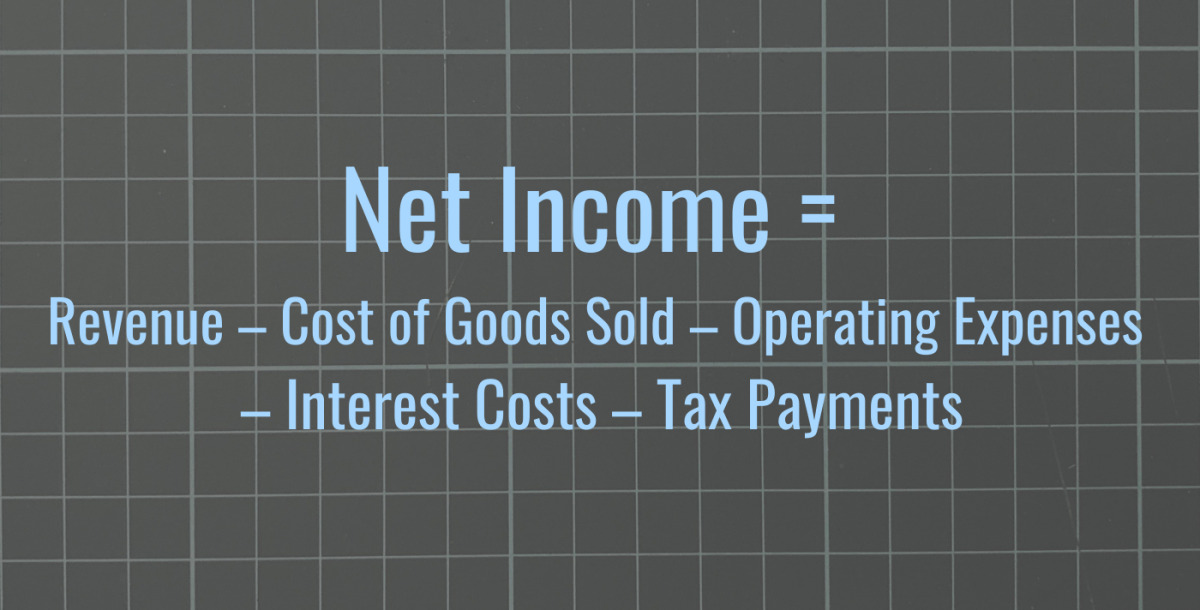

Net Income What Is It How Is It Measured

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified. Taxpayers use this form. Youll owe the 38.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Form 8960 Net Investment Income TaxIndividuals. This tax is also known as the net investment income tax NIIT.

The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income. Your net investment income is less than your MAGI overage. Additionally health and education.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. Gains from the sale of stocks mutual funds and most other capital assets that you held for more than one year which are considered long-term capital gains are taxed at either a. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

B the excess if any of. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. B and C owe Net Investment Income Tax of 1900 50000 X 38.

For tax years beginning after Dec. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. A the undistributed net investment income or.

We do not calculate the potential tax consequence. This calculator reflects the Metro Supportive Housing Services SHS Personal Income Tax for all OR county residents on taxable income of more than 125000 for single. Tax Calculator 2021 Tax Returns Refunds During 2022.

The threshold amounts are based on your filing status. For more information on the Net Investment Income Tax refer to Tax. For tax years beginning on or before Dec.

Single or head of household 200000. D a single filer earns 45000 in wages and sells her principal residence that she has owned and resided. We are only required by the IRS to indicate annuity distributions.

Your household income location filing status and number of personal exemptions. Married filing jointly or.

![]()

1040 Income Tax Calculator Free Tax Return Estimator Jackson Hewitt

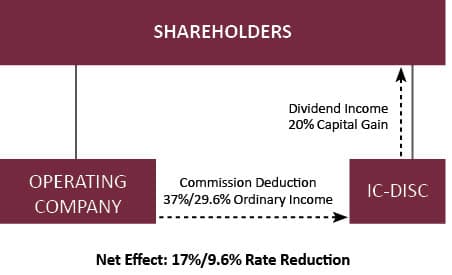

Ic Disc Exporter Tax Incentives Kbkg Tax Incentives

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

How To Calculate Taxable Income H R Block

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

2022 Capital Gains Tax Rates By State Smartasset

What Is Net Investment Income Tax Overview Of The 3 8 Tax

What Is Net Income Definition Calculation Example Thestreet

Simple Tax Refund Calculator Or Determine If You Ll Owe

How Much Tax Do You Pay When You Sell A Rental Property

Understanding The Net Investment Income Tax Fmp Wealth Advisers

Taxable Income Formula Examples How To Calculate Taxable Income

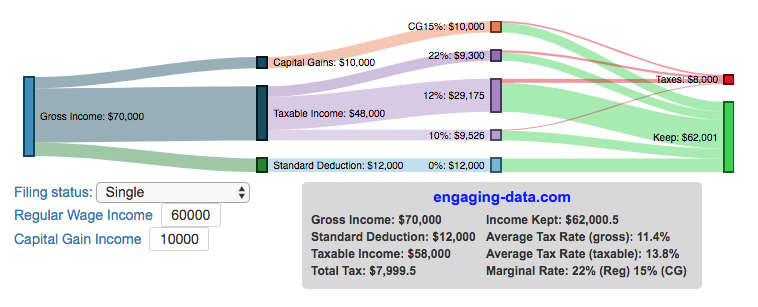

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

What Is Form 8960 Net Investment Income Tax Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc():gifv()/GettyImages-1160172463-9d00a407bf63428a9bb030b683d1c863.jpg)